According to a 2017 study performed by the Insurance Information Institute, 13% of all motorists (approximately one in eight drivers) are uninsured (https://www.iii.org/fact-statistic/facts-statistics-uninsured-motorists). This statistic means that we are all subject to the daily risk that an uninsured driver can cause serious injuries and even death without accountability. Due to some else’s negligence, we can be left holding the bag for medical bills, lost income, and other damages caused by someone else’s negligence.

In light of this imminent danger, we counsel all of our clients to purchase uninsured and/or underinsurance coverage, which protects you and passenger in your vehicle against an at-fault driver that has little to no insurance. This coverage helps pay for medical bills and other damages, when claims exceeds the at-fault driver’s insurance (underinsured), or when the at-fault driver has no insurance (uninsured).

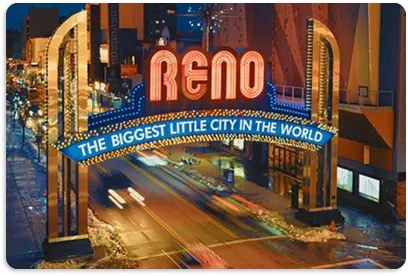

Similar to other states, Nevada possesses some laws which protect you in this context. For example, Nevada Revised Statute 687B.145 makes it mandatory for carriers to offer uninsured and underinsured coverage at the time of purchase equal to the limits of coverage of bodily injury ($25,000 per claim and $50,000 per accident). https://www.leg.state.nv.us/NRS/NRS-687B.html#NRS687BSec145 Courts have held that insurance companies may not deny coverage merely because they have failed to provide policy holders with an opportunity to pay a premium. Ippolito v. Liberty Mutual Insurance Co., 101 Nev. 376, 705 P.2d 134 (1984).

As a result of the “must offer” requirement, we have been successful in finding coverage for our clients when they never purchased additional coverage, because carrier at issue cannot provide proof (a written waiver) that Uninsured or Underinsured Coverage was offered. Simply put, if you carried cannot provide that it offered coverage, you get it, even if you never paid for it.

Our courts have strictly construed provisions of the uninsured motorist statute in favor of recovery for the insured. State Farm Mut. Auto. Ins. Vs. Hinkel, 87 Nev. 478, 483, 488 P.2d 1151. The courts will read into the contract of uninsured-underinsured motorist coverage equal to the limits of bodily injury coverage sold to the individual policy holder. Ippolito v. Liberty Mutual Insurance Co., 101 Nev. 376, 705 P.2d 134 (1984).

If you or someone you know is injured by an uninsured or underinsured driver, give us the opportunity to find insurance coverage you think doesn’t exist. Not only may we be able to hold the at-fault driver accountable, but you may have a claim against your own carrier for the damages you have incurred.